https://www.avisar.ca/wp-content/uploads/2022/04/2.png

350

400

Tanya Lind

https://www.avisar.ca/wp-content/uploads/2021/11/Avisar_logo2015_PMS8400-300x34.png

Tanya Lind2024-04-17 11:45:002024-04-17 12:33:14Federal Budget 2024: Personal Measures

https://www.avisar.ca/wp-content/uploads/2022/04/2.png

350

400

Tanya Lind

https://www.avisar.ca/wp-content/uploads/2021/11/Avisar_logo2015_PMS8400-300x34.png

Tanya Lind2024-04-17 11:45:002024-04-17 12:33:14Federal Budget 2024: Personal MeasuresNavigating Canadian tax laws can be confusing. Pretty much everything you do has tax implications. Tax laws and interpretations change and become more complex every year. It’s impossible for business owners to keep up.

With expertise in Canadian tax planning and compliance, our tax team provides you with the clarity needed to take maximum advantage of current tax legislation.

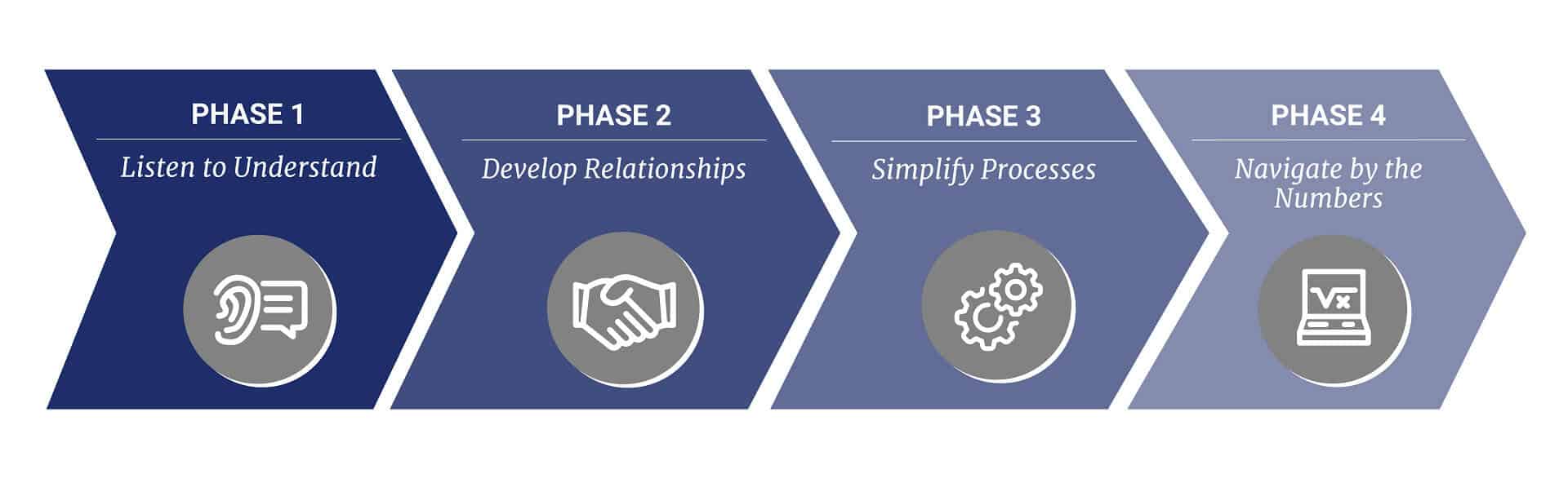

Our Process

Our process is designed to make your life easier by equipping you with the information and insights you need to make the right decisions for your business, and the support team to keep things running smoothly.

Phase One – Listen to Understand

We listen closely to learn what is important to you, your business and your customers. Understanding your industry and what makes your company unique allows us to come alongside you with confidence that we are on the same team. We share important industry specific knowledge to help you better understand the business and tax environment that your company functions in, to increase your competitive advantage. We thrive when helping entrepreneurial-minded individuals and are genuinely excited to celebrate your success.

Phase Two – Develop Relationships

Each team member is empowered to develop great client relationships, regardless of their position in the firm. Even if your primary contact is on a well-deserved holiday, there is always someone available to assist you. We foster a culture of loyalty and genuine caring among our staff who assist each other in our collaborative efforts to achieve your goals. Our high level of staff retention allows us to develop long-lasting relationships with you and to build trust, to our mutual benefit.

Phase Three – Simplify Processes

Our knowledgeable team members apply their years of experience to simplify and streamline your accounting and reporting systems. If changes to your organizational structure or daily operations will ease frustrations or save you time and money, we will guide you through the process.

Phase Four – Navigate by the Numbers

We help you navigate the natural accounting cycle of your business, be it monthly, quarterly or annually. Our staff responds promptly to phone calls and emails, making ourselves accessible to you every step of the way. Understanding your accounting cycles ensures that meaningful information is available to management, accurate reporting is delivered to interested parties, and tax requirements are filed in a timely manner with government agencies, making it easier for you to focus on your business.

Avisar makes a difference by taking care of business effectively and efficiently. As an accounting, tax, and business advisory firm, Avisar has the knowledge and strategic vision it takes to improve your business processes, take advantage of new opportunities, and help you succeed over the long run.